There is an up-and-down in the cryptocurrency markets, which varies greatly depending on what particular cryptos you are buying. Timing your crypto purchase can be difficult, if not treacherous, thing to try because there are all kinds of elements going into a coins price. For instance, how much will ethereum be worth in 2030? The […]

Saving money on home décor

We are entering a challenging period where our money may not go as far as it did before. Our mortgages are rising, energy bills are rising, and the cost of everyday items seems to be rocketing. Therefore, when it comes to decorating our home, we are likely going to need to make some compromises and […]

The Perfect Price Point — Is There Such A Thing?

The price of your product is almost always a driver of purchasing behavior. Price your product too low and you may cut into your profit margins or send a message that your product’s quality is lacking. Price it too high, however, and you lose potential customers and purchases. That is why determining your product’s perfect […]

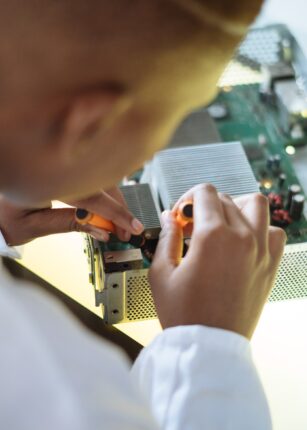

The Increasing Role of Predictive Maintenance Technologies

Preventive and predictive maintenance have the same goal: to keep industrial equipment in good working order, increase production, and reduce downtime. Both techniques, however, are fundamentally different. While a planned downtime in preventive maintenance may be inconvenient and represents a decrease in overall capacity availability, it’s highly preferable to the unplanned downtime of reactive maintenance, […]

Investing in saving money on energy

The cost of energy, like the cost of petrol, food, and clothing, has rocketed. For many families and households, this may be a worrying time, and are searching for different ways to save money and energy, particularly long-term ones which will help during the colder months. If you have already tried to cut the cost […]

Why hire a defense attorney in Minnesota when there’s a public defender?

Sometimes, we might find ourselves on the other side of the law. There are so many reasons for one to get a criminal charge. It may also be the case that you are wrongly accused. Regardless of your situation, a criminal conviction will be a life-altering event, and you should try your best to avoid […]

How to Find a Good First Checking Account for Your Children

As your children grow up, one of the things you’ll likely have to help them do is create their first checking account. A checking account is basically a requirement for most people, as it’s the easiest way to get paid and many companies don’t accept cash as a method of payment. Online-only accounts like the […]

10 Steps to Buying Your First Home (First Time Home Buyer’s Guide)

Buying your first home can be exciting, but it can also be stressful without a plan. To stay on track and make sure you can make this goal a reality, we’ve outlined some steps to follow that will help you move into that new home in no time and to really help with that stress […]

The Growing Use of Technology in Manufacturing

Advancements in technology are quickly changing the landscape of virtually every industry, especially that of manufacturing. Modern advances are enabling factory operators to streamline production processes, innovate at a faster pace than ever before, and deliver higher quality products to meet changing demands. Because of the versatility of these technologies, there are a number of […]

Why 2021 is the best time to buy (if you’re quick!)

While 2020 has seen many of us struggle being cooped up in the house for weeks at a time, 2021 could be your year. With all the announcements that have been released this year to help the property market get back on its feet, 2021 is certainly the time to be getting on the property […]

Follow

Follow